What are investors paying for investment management services in Canada?

by Stephan Desbiens, Partner & Associate Portfolio Manager at Exponent Investment Management Inc.

I often get asked about investment management fees. “How much am I paying?” or “How much will you charge to manage my money?” are the 2 most often asked questions. Of course it would be nice to receive any advice or service for free, but to quote Stephen King: “You pay for what you get, you own what you pay for… and sooner or later whatever you own comes back home to you”. This is especially true with investment fees in Canada.

Here’s a rundown of the fees you can expect to pay for the most common types of investment strategies in Canada:

For the “Do-it-yourselfer” or DIY

This type of investor has the time, interest, knowledge and inclination to tend to their portfolio through all market conditions, as well as, the decisiveness to execute their chosen strategy. Like constructing a home, DIY is the most cost-effective way to build, but the above factors will determine the quality of the construction of your home and how well you will sleep in it at night.

Do-it-yourself Fees

Self-directed annual administration fees between $0 and $59 per year. Trading fees ranging from $0 to $30 per trade for stocks and exchange traded funds (ETF). ETF fees range from a few basis points to slightly over 1% annually.

“Robot”, “Smart” or “Simple” Portfolios

The target market for these relatively new products are millennials who are fee sensitive and do not require or believe in the value of the traditional advice channel.

Robot Fees

Usually these are held within a fee-based platform which means they charge a percentage on your assets under management. The fee range is usually between .50% and 1% per year depending on the chosen service levels.

Big Bank Advisors

Bank clients are usually dedicated to their bank’s brand and the perceived security represented by it. Banks host a small army of portfolio counsellors, investment advisors and mutual fund sales people. You’ll find the widest range of products and solutions with banks. Advisor work experience and knowledge base will also vary greatly, as will the client experience.

Bank Fees: Portfolio Counsellor all-in fees range between 75 basis points and 1.25% annually on managed portfolios. Investment Advisors can charge per transaction from 1% to 3% or make fee-based arrangements with clients. Fee-based programs range mostly between 50 basis points (5M+) and 1.5% per year. Add administration, custodial, sub-advisor and/or other fees as negotiated with your Advisor. Bank in-branch advisors usually focus on the bank’s smaller investment clients. They mostly use mutual funds or ETFs and charge fees which are imbedded in the product (clients don’t see the charge as it is drawn from the fund itself). These typically range between 1.5% to 3% annually. Account size minimums usually apply with banks, so checking with your bank and being in the appropriate channel is an important aspect of investing within banks.

Insurance Agents

When you think insurance, think insurance premiums. Just like auto or home policies, premiums are charged to insure your portfolio. Insurance clients are typically people that need life, disability or critical illness first. Insurance company investment product line-ups are often complex and expensive. An insurance agent’s investment knowledge and business focus varies greatly.

Insurance Fees: Fees for investment products typically range between 2% and 4% annually. Most insurance agents make use of sub-advisors (where someone else manages the money I.e. Mutual funds). Annual administration and other fees may also apply.

Portfolio Managers

Most Portfolio Managers (PM) hold CFA or CIM designations. Portfolio Managers typically work directly with private clients or as sub-advisors for institutional clients, like pension funds and mutual funds. They are often smaller boutique type firms where the lead PM will be an owner in the firm.

PM Fees: Portfolio Managers usually work within a fee-based program ranging between 50 basis points to 1.5% on assets managed by the firm. Administration, trading and custodial fees may also apply.

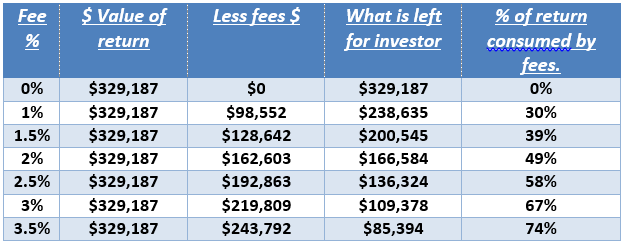

How does it add up?

The illustration below is based on a $100,000 investment earning 6% over 25 years (income taxes are not factored).

Stephan Desbiens, Partner & Associate Portfolio Manager at Exponent Investment Management Inc. in Ottawa.

Stephan@ex-ponent.com