by Iris Winston

The good news is that the rate of inflation in Canada has slowed down. It is now well below the horrifying peak of 8.1 percent in June 2022 during the height of COVID-19. The Bank of Canada has cut interest rates more than once and it is widely anticipated that further cuts are coming. Reports also indicate that supply chains are moving more smoothly these days. That may reduce wait times for some products. There’s no word on how this will affect prices.

I’m not optimistic. The bad news is that Canada still has a massive deficit of $40 billion — a number so big that it boggles the mind. Further, on a day-to-day basis, it seems that even though the economy looks healthier, it is unlikely to have a positive effect on shrinkflation or skimpflation.

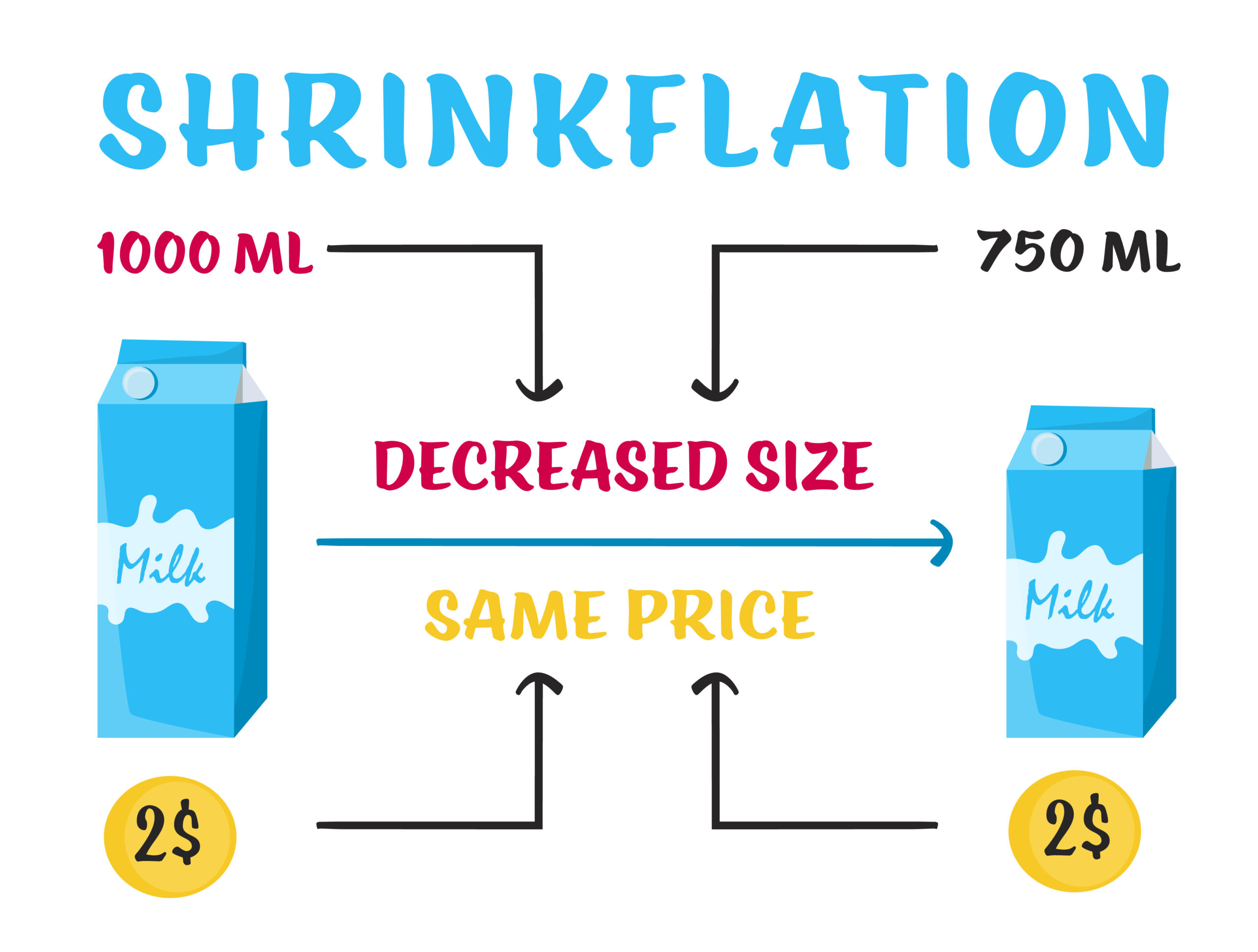

Shrinkflation, the official name for reducing container sizes while keeping prices the same or even edging them up, makes grocery shopping in particular increasingly irritating. Boxes are as much as 100 grams lighter, even though artful packaging often disguises the reduction. The weight is printed on the packages, however. Is it my imagination that the print is also smaller? Meanwhile, the prices on the items seem to move in one direction only—upwards. Bottles and jars also appear to be on a highly effective dieting program as they get slimmer by the week and contain less and less, while pricing doesn’t follow suit.

In many cases, there’s also skimping inside the packages. For example, the name brand of the ingredients for a baked chicken recipe no longer includes the plastic bag required to shake up the coating for the pieces of chicken. Although the excuse might be that this is an attempt to reduce the use of plastic bags, the no-name version of a similar product still includes the necessary shaking bag and remains cheaper.

In many cases, there’s also skimping inside the packages. For example, the name brand of the ingredients for a baked chicken recipe no longer includes the plastic bag required to shake up the coating for the pieces of chicken. Although the excuse might be that this is an attempt to reduce the use of plastic bags, the no-name version of a similar product still includes the necessary shaking bag and remains cheaper.

There’s further skimping in terms of service. Don’t be fooled that the self-checkouts now seen in many supermarkets and big-box stores are for the customers’ convenience. Self-service of any kind means that you do more and the business can manage with fewer employees. There’s a wonderful scene in the 1985 movie Back to the Future, set in 1955, in which several attendants at a gas station rush out to fill a vehicle with gas, check the oil, and polish the windows and mirrors, all at record speed. Today, the majority of gas stations are self-serve and the price of gas sounds reasonable if it is no more than $1.50 a litre.

One relatively acceptable way to economize is demonstrated by some companies’ teabags, once round, now square, so making it possible to produce more teabags while using less material. (Possibly the bags now contain fewer leaves which may be of lesser quality, but that’s hard to determine.) As pairs of the square teabags are now attached to each other, the time saved by not separating them for the convenience of the consumer is presumably also an economy measure. But, it seems, customer convenience is not at top of mind for businesses anxious to maintain a healthy bottom line.

Then there is the pricing game. On week one an item costs X. The following week it rises to Y. Then, a week or two after that, the same item goes on sale back to X. A few times after that, the base price increases to become nearer to Y+. Undoubtedly, consumers notice what’s happening. But their only defence is to decide not to buy an item when the increase has gone further than the level they can tolerate or the container is now just obviously much smaller.

It also seems likely that shrinkflation and skimpflation will continue and consumers will get less and less for their money, even if the rate of inflation continues to drop.